Receiving W-2 and 1099 Tax Forms. When it comes to keeping track of day-to-day business expenses many entrepreneurs go digital.

I Need To Add A 2nd Business To My Qb Self Emp Acc

He most recently spent two years as the accountant at a commercial roofing company.

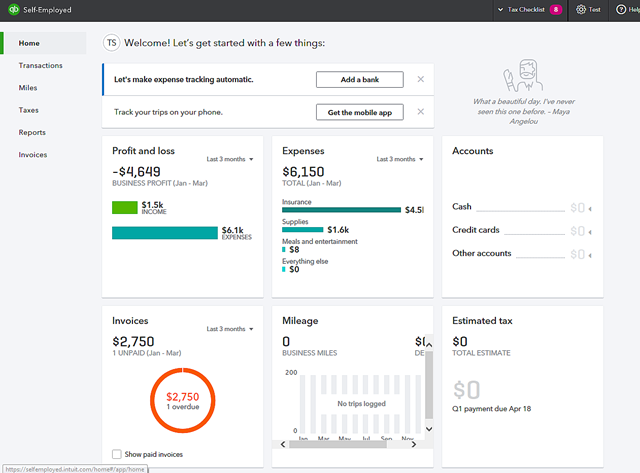

. QuickBooks Self-Employed users have found billions in potential tax deductions by using this automatic mileage tracker attaching receipts to business expenses creating invoices and categorizing business expenses while separating from your personal finances and get all the tax refunds a self-employed business owner is entitled to. If youre an Independent Contractor and need to separate your business and personal expenses you can use the QBSE. The main difference between both programs is that QuickBooks Self-Employed is designed for Independent Contractors while Simple Start is for Small Businesses.

QuickBooks Self-Employed asked 1026 self-employed people in the United States about how they track their business expenses sort through stacks of receipts and handle the strain of tax season. While 82 of self-employed workers create a budget for their business only 22. QuickBooks Self-Employed is the ideal product for freelancers real estate agents and independent contractors like Uber and Lyft drivers.

QuickBooks Self-Employed helps you stay in control of your business finances and prepare for tax time while on the go with easy sales tax expense mileage and invoice tracking. The length of time you should keep a document depends on the action expense or event which the document records. If you were employed for part of the year your employer will likely report your employee income to the Internal Revenue Service IRS on Form W-2In addition you may also receive self-employment income that your customers reported to the IRS on a 1099-NEC form 1099-MISC in prior years.

But having a budget and sticking to it are two different matters. Heres a video link from Intuit on how QuickBooks small businesses use QuickBooks Payroll. This software was created to help freelancers stay organized each year for.

Generally you must keep your records that support an item of income deduction or credit shown on your tax return until the period of. QuickBooks Self-Employed is an Intuit product with a cloud-based online interface and a mobile app. QuickBooks Online and QuickBooks Self-Employed are two different versions.

Use QuickBooks Sales Tax Tools.

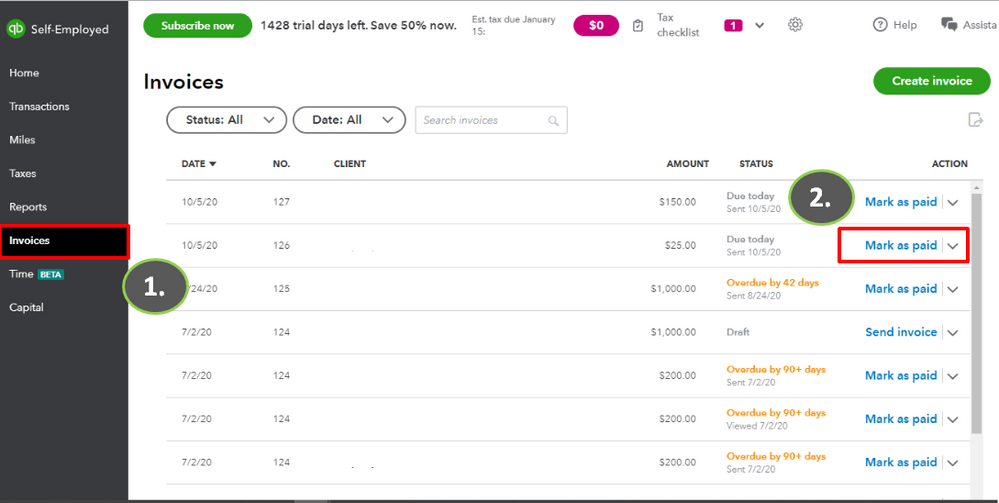

Solved How To I Edit My Invoices With Self Employed Onlin

What S The Scoop With Quickbooks Self Employed Insightfulaccountant Com

Quickbooks Self Employed Annual Tax Guide

Solved How To Add A New Self Employed Client

Setup A Draw From Quickbooks Self Employed

Matching Emailed Receipts In Quick Books Self Empl

0 comments

Post a Comment